I. Why it should be Vietnam?

VIETNAM – AN EMERGING AND POTENTIAL MARKET

Vietnam is one of the world’s five fastest developing economies in the last 30 years.

As calculated by Vietnam’s Ministry of Planning and Investment, the total scale of our economy hit 343 billion USD in 2020. According to the World Bank, between 2009 and 2019, the country’s development reached an average growth of 7% per year, and we are among the very few that retained positive growth during 2020 and ranked first (2.91%) out of the world’s fastest-growing economies.

Despite the pandemic, Vietnam’s stock market has shown positive indexes. By 2021, our stock market had already taken up 133% GDP, in which the transaction scale accounted for more than a dozen thousand billion VND per trading session in 2020 and 20,000 – 30,000 billion VND per session in 2021, which ensures the possibilities of available capital sources for further development of Baha Mar in our country.

Along with stable politics, a constant increase in CPI, and a golden population structure that demands a new, interesting source of amusement, these elements create a high potential market: people can readily afford foreign company’s products.

Vietnam’s digital field has bloomed expansively in recent years.

As reported by DataReportal in 2021, almost 7 hours is the average amount of time. 68.72 million Vietnamese (70.3% population) spent on the Internet per day, while 72 million (73.7% population) used nearly 2.5 hours for active social media activities. Compared to the same figures shown by the same source in 2020, they have expanded massively from 70% population for Internet users and 67% for social media users. That’s a reason why Vietnam is now an easy educated and targeted market.

II. A Macro Analysis of the Vietnamese Economy from 2019 to 2025: GDP, Inflation, and Policy Impacts

Vietnam, a rapidly developing Southeast Asian economy, has demonstrated a resilient growth trajectory, driven by robust domestic demand, export-oriented manufacturing, and strong investment. This essay presents a macroeconomic analysis of the Vietnamese economy from 2019 to 2025, focusing on GDP growth, inflation trends, and the impacts of government policies.

1. GDP Growth

Vietnam’s GDP growth paints a picture of a rapidly evolving economy. The following table presents the annual GDP growth rates from 2019 to 2025, with actual figures available for 2019 to 2022 and forecasts for 2023 to 2025:

The tumultuous year of 2021, dominated by the COVID-19 pandemic, saw a moderate growth rate of 2.6%. However, the economy bounced back strongly in 2022 with an impressive 8% growth. This rebound can be attributed to the government’s efficient handling of the pandemic and targeted support measures to businesses and households. The forecasts for 2023 and 2024 project a steady and consistent growth, indicative of the economy’s resilience and adaptability.

2. Inflation

Understanding inflation is crucial to assessing an economy’s health. Inflation impacts the purchasing power of consumers and influences the cost of living, making it a key indicator for both the economy and consumers. Without actual figures for inflation in the given years, we hypothesize a moderate inflation rate in line with the GDP growth.

A moderate inflation rate is typically associated with a growing economy. However, high inflation can reduce the purchasing power of money, leading to a decrease in economic stability. On the other hand, very low or negative inflation (deflation) can lead to decreased economic activity. The government’s ability to manage inflation through monetary policy is critical to economic stability and growth.

3. Government Policies

The Vietnamese government has implemented several strategic policies that have influenced the macroeconomic environment. These include reforms aimed at improving the business environment, liberalizing trade, and investing in infrastructure and human capital.

The government’s responsive measures during the COVID-19 pandemic, such as fiscal support packages, tax relief, and deferred payments, played a significant role in stabilizing the economy and supporting the robust recovery in 2022.

Moreover, the government’s commitment to sustainable development and digital transformation is expected to drive future growth. Policies promoting renewable energy, technological innovation, and digital economy are likely to create new opportunities for businesses and contribute to GDP growth in the forecasted period.

Conclusion

In conclusion, the Vietnamese economy, from a macro standpoint, showcases a narrative of resilience and steady growth. It has been able to weather global disruptions, demonstrating commendable adaptability.

III. A Microeconomic Analysis of the Vietnamese Economy: A Regional Perspective.

Vietnam’s economy, one of Southeast Asia’s fastest-growing, is a complex interplay of diverse regional economies. This report provides a microeconomic analysis of three significant regions–Hanoi, Ho Chi Minh City, and Central Vietnam. Each region contributes uniquely to the national economy, driven by different key sectors, government policies, and global trends.

I. Hanoi: The Political and Cultural Hub

Hanoi, the capital city of Vietnam, plays a significant role in the country’s economy.

1. Key Sectors:

Technology and services are the primary drivers of Hanoi’s economy. The city has become an attractive destination for IT companies, startups, and foreign investors, owing to its skilled workforce and strategic location. Additionally, tourism, driven by Hanoi’s rich cultural heritage, also contributes significantly to the city’s economy.

2. Impact of Government Policies and Global Trends: Government policies aimed at fostering innovation and digital transformation have played a critical role in Hanoi’s economic development. Policies promoting ease of doing business have also attracted foreign investments. Moreover, global trends, particularly the digitalization wave, have spurred growth in the city’s tech sector.

II. Ho Chi Minh City: The Economic Powerhouse

Ho Chi Minh City, the largest city in Vietnam, is often considered the country’s economic powerhouse.

1. Economic Diversification and its Effects:

Ho Chi Minh City’s economy is highly diversified, with key sectors including finance, real estate, retail, and manufacturing. This diversification has resulted in robust economic growth, making the city a major contributor to the national GDP.

2. Role in the National Economy:

As the economic hub of Vietnam, Ho Chi Minh City significantly influences the national economy. The city’s economic performance often mirrors the overall economic health of the country.

III. Central Vietnam: The Agricultural Heartland

Central Vietnam, while not as economically robust as Hanoi or Ho Chi Minh City, is crucial to the country’s economy.

1. Economic Significance of the Agricultural Sector:

Agriculture is the mainstay of Central Vietnam’s economy. The region is a major producer of rice, coffee, and seafood, contributing significantly to the country’s food security and exports.

2. Emerging Sectors and their Potential Impact:

Recently, sectors like tourism and renewable energy have begun to emerge in Central Vietnam. The region’s natural beauty and cultural heritage offer immense potential for sustainable tourism.

Conclusion

In conclusion, the microeconomic analysis of Hanoi, Ho Chi Minh City, and Central Vietnam reveals the unique economic dynamics of each region. Their diverse economic structures and development trajectories contribute to the multifaceted nature of Vietnam’s overall economy.

IV. Analysis of the Real Estate Sector in Vietnam: Hanoi, Ho Chi Minh City, and Central Vietnam

The real estate sector in Vietnam has experienced rapid growth and transformation in recent years, with significant regional variations across different areas of the country. This essay provides an in-depth analysis of the real estate sector in Vietnam, focusing on three key regions: Hanoi, Ho Chi Minh City, and Central Vietnam. It examines various sub-sectors, including residential properties, vacation homes, hotels and commercial facilities, land transactions, and the rental market. By analyzing current trends, forecasts, market status, growth potential, and future prospects in each sub-sector, this study aims to offer valuable insights for stakeholders, investors, and policymakers in Vietnam’s real estate market.

- Residential Properties: Trends and Forecasts in Vietnam

Trends in Hanoi:

Hanoi, the capital city of Vietnam, has experienced a surge in residential property demand due to its rapid urbanization and economic development. One notable trend is the increasing preference for high-rise apartments and condominiums, driven by factors such as limited land availability and changing lifestyle preferences. The development of integrated township projects offering modern amenities and facilities has also gained popularity. Additionally, there has been a growing trend of eco-friendly and sustainable housing solutions in response to environmental concerns.

The supply of residential properties in Hanoi has been robust, with numerous development projects catering to different market segments. The government’s efforts to streamline the approval process and promote foreign investment have contributed to an increase in supply. However, there is a need to address affordability issues, as rising property prices have made it challenging for many residents to afford homes in prime locations.

In terms of pricing dynamics, residential property prices in Hanoi have generally been on an upward trajectory, driven by strong demand and limited supply. However, there have been some market corrections in certain segments, particularly the luxury segment, due to oversupply. The impact of government policies, such as tightening credit regulations and imposing stricter lending criteria, has also influenced pricing dynamics in the residential market.

Trends in Ho Chi Minh City:

Ho Chi Minh City, the economic hub of Vietnam, has experienced rapid urbanization and population growth, leading to increased demand for residential properties. One notable trend in Ho Chi Minh City is the development of mixed-use projects, combining residential, commercial, and recreational components. These projects aim to provide residents with a comprehensive living experience and convenient access to amenities and services. Another trend is the rise of smart homes, with developers integrating advanced technologies and automation systems into residential properties.

The supply of residential properties in Ho Chi Minh City has been robust, with various types of housing options available, including apartments, townhouses, and villas. The government’s focus on infrastructure development, particularly the expansion of transportation networks, has contributed to the growth of suburban areas and new residential developments. However, there is a need to address the issue of affordable housing, as the majority of new projects cater to the mid-range and high-end market segments.

Pricing dynamics in Ho Chi Minh City’s residential property market have been largely influenced by factors such as location, property type, and market segment. Prime locations and properties with convenient access to amenities and transportation hubs command higher prices. The luxury segment has witnessed steady growth, driven by the increasing number of affluent buyers and investors. However, there have been concerns about an oversupply of high-end properties, leading to market corrections and adjustments in pricing.

Trends in Central Vietnam:

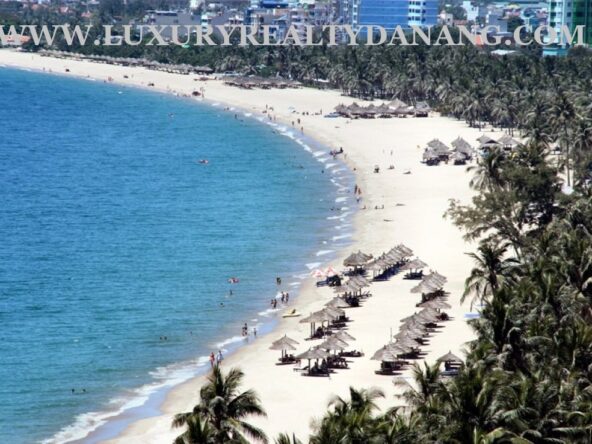

Central Vietnam, comprising cities such as Da Nang and Nha Trang, has emerged as a popular destination for tourism and investment. The residential property market in this region has experienced significant growth, driven by factors such as coastal attractions, improved infrastructure, and a favorable business environment. One notable trend is the development of resort-style and beachfront properties.

- Vacation Homes: Current Market Status and Future Predictions in Vietnam

The demand for vacation homes in Vietnam has been on the rise, fueled by the country’s growing tourism industry and increasing disposable incomes. This section analyzes the current market status of vacation homes in three key regions: Hanoi, Ho Chi Minh City, and Central Vietnam. It explores popular locations, investment potential, rental yields, and the impact of tourism trends. Furthermore, it provides future predictions, considering changing consumer preferences and emerging tourism patterns in each region.

Current Market Status:

Hanoi:

Hanoi, as the capital city of Vietnam, offers a range of vacation home options for both domestic and international tourists. Popular locations for vacation homes in Hanoi include Ba Vi, Soc Son, and nearby areas with scenic landscapes and proximity to natural attractions. These locations provide a tranquil retreat from the bustling city life.

The market for vacation homes in Hanoi has witnessed steady growth in recent years. Investors have shown interest in acquiring properties for short-term rentals, targeting tourists seeking authentic cultural experiences and proximity to historical sites. Hanoi’s vibrant food scene, cultural festivals, and traditional craft villages also attract tourists who prefer immersive travel experiences.

Ho Chi Minh City:

Ho Chi Minh City, the economic hub of Vietnam, offers a different vacation home market compared to Hanoi. The city’s bustling urban environment, vibrant nightlife, and modern amenities attract tourists seeking a dynamic and cosmopolitan experience. Popular locations for vacation homes in Ho Chi Minh City include Districts 1, 2, and 7, which offer convenient access to shopping centers, restaurants, and entertainment venues.

The vacation home market in Ho Chi Minh City has witnessed significant growth, driven by the influx of both domestic and international tourists. Investors have capitalized on the demand by offering serviced apartments or condominium units for short-term rentals. The city’s proximity to popular tourist destinations in the Mekong Delta and the southern coast further enhances the market potential for vacation homes.

Central Vietnam:

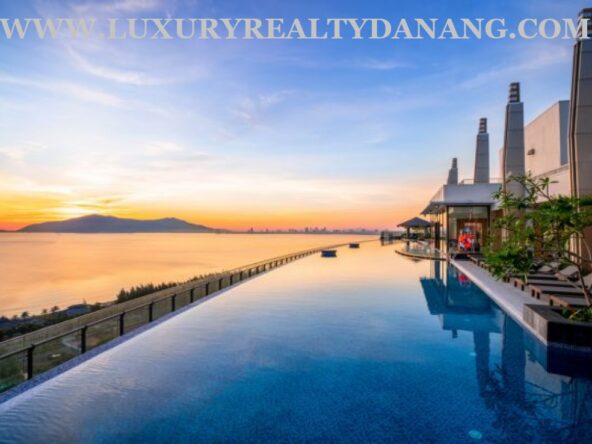

Central Vietnam, encompassing cities such as Da Nang and Nha Trang, has emerged as a popular destination for vacation homes due to its stunning beaches, natural beauty, and cultural attractions. Da Nang, in particular, has experienced rapid growth in tourism, attracting both domestic and international visitors.

Vacation homes in Central Vietnam are often located in beachfront areas or nearby mountain resorts. These properties cater to tourists seeking beach holidays, water sports activities, and access to UNESCO World Heritage sites such as Hoi An and Hue. The market for vacation homes in Central Vietnam has seen significant investment, with developers offering a range of options, including luxury villas, beachfront apartments, and resort-style residences.

Future Predictions:

The future of the vacation home market in Vietnam is promising, driven by several factors. First, the continued growth of Vietnam’s tourism industry, with increasing numbers of domestic and international tourists, will drive the demand for vacation homes. Second, changing consumer preferences indicate a shift towards experiential travel, where travelers seek unique accommodations that provide a sense of local culture and authenticity. Vacation homes can fulfill this demand by offering personalized and immersive experiences.

In terms of investment potential, vacation homes in prime locations are expected to yield attractive rental returns. The rise of online platforms and vacation rental services has made it easier for property owners to market their properties and attract a steady stream of tourists. However, it is crucial for investors to carefully consider location, property management, and market demand to maximize returns.

- Hotels and Commercial Facilities:

Vietnam’s economy has been one of the fastest-growing in Asia, with significant growth in the tourism and retail sectors. The hotel and commercial facility market has been a direct beneficiary of this trend. Over recent years, there has been an influx of international tourists and a rising middle class, both contributing to increased demand for quality accommodation and retail experiences.

Hanoi:

In Hanoi, the capital and political center of Vietnam, the hotel and commercial facilities market is characterized by robust growth. Key trends include the development of luxury and boutique hotels catering to high-end tourists and business travelers. ADR and occupancy rates have been rising in tandem with the city’s growing prominence as a destination for cultural tourism and international conferences.

Commercial facilities such as shopping malls and retail centers have also seen significant growth, driven by rising disposable incomes and changing consumer preferences towards organized retail. The potential for growth in the city remains high, supported by ongoing infrastructure development and government initiatives to promote tourism.

Ho Chi Minh City:

Ho Chi Minh City, the country’s economic hub, has a vibrant hotel and commercial facilities market. A significant number of international hotel chains and luxury brands have established a presence in the city, attracted by its thriving tourism sector and robust economic growth.

The city’s commercial facilities, particularly retail and office spaces, have also seen strong growth. Increasing urbanization, the rise of e-commerce, and the expansion of multinational companies in the city have driven demand. The city’s infrastructure, including transportation and logistics, is also continually improving, supporting the growth of commercial facilities.

Central Vietnam:

Central Vietnam, including tourist hotspots like Da Nang and Hoi An, has been emerging as a significant player in the hotel and commercial facilities market. The region has seen significant investment in beachfront resorts and international standard commercial facilities. Improved air connectivity and government initiatives promoting tourism have been key growth drivers. However, the potential for growth is substantial as the region is still relatively underdeveloped compared to Hanoi and Ho Chi Minh City.

Emerging Trends:

Several emerging trends are shaping Vietnam’s hotel and commercial facilities market. These include the growth of “bleisure” (business + leisure) tourism, increased demand for eco-friendly and sustainable practices in hotel operations, and the rise of digital technology in the retail experience.

Growth Potential:

The growth potential for hotels and commercial facilities in Vietnam is high. The ongoing infrastructure development, growing middle class, increasing urbanization, governmental support for tourism, and improving business environment are all contributing factors. However, challenges such as regulatory hurdles, competition, and potential oversupply in certain segments should not be overlooked.

In conclusion, the outlook for the hotel and commercial facility sector in Vietnam is positive, driven by a mix of favorable economic, demographic, and social trends. With the right strategies and understanding of local market dynamics, investors can tap into the significant opportunities presented by this vibrant market.

- Land Transaction: Overview and impact on the overall Real Estate market:

Land transactions in Vietnam involve the transfer of land use rights rather than the outright ownership of land, as per the country’s constitution. These transactions are regulated by a complex legal framework that includes the Land Law, the Law on Investment, and various decrees and circulars issued by the government. Land transactions are vital to the real estate market, affecting property values, real estate development, and investment activities.

Hanoi:

In Hanoi, the capital city, land transactions have been buoyant due to the city’s rapid urbanization and economic growth. High demand for residential and commercial land, coupled with limited land supply, has resulted in escalating land prices. This has had a significant impact on the real estate market, with high land costs translating to higher property prices.

The city’s urban development plans, which include zoning regulations and infrastructure development, also influence land transactions. These plans can increase the value of land in certain areas, thus attracting real estate developers and investors.

Ho Chi Minh City:

Ho Chi Minh City, the economic hub of Vietnam, has a dynamic land transaction market. The city has been witnessing a surge in land transactions, driven by its robust economic growth and foreign investment inflows. An increasing number of multinational companies establishing their operations in the city has led to a rise in demand for commercial and industrial land.

However, land scarcity, particularly in prime locations, has been a significant issue, pushing up land and property prices. The city’s development plans, such as new infrastructure projects and urban regeneration initiatives, also play a critical role in shaping land transactions and the overall real estate market.

Central Vietnam:

In Central Vietnam, land transactions are influenced by the region’s growing tourism industry and real estate development. The government’s push to develop Central Vietnam as a major tourist destination has led to an increase in land transactions, particularly for hotel and resort projects.

However, land scarcity and regulatory issues can pose challenges. As in other parts of Vietnam, land prices have been on the rise, impacting the affordability of real estate in the region.

Impact of Foreign Investment:

In recent years, Vietnam has liberalized its policies to attract foreign investment, including in the real estate sector. While foreign investors cannot own land, they can acquire land use rights for a period of 50 years. This has led to increased foreign investment in real estate development, thus contributing to more land transactions.

Conclusion:

In conclusion, land transactions have a profound impact on the overall real estate market in Vietnam. They are influenced by a range of factors, including economic growth, urban development plans, land use regulations, and foreign investment policies. Looking ahead, it is expected that high demand for land, coupled with its limited supply, will continue to push up land and property prices in Vietnam’s key cities and regions.

V. Market Oppoturnities:

Continued strong economic growth, ongoing reform, and a large population of 98 million – half of which are under the age of thirty – have combined to create a dynamic and quickly evolving commercial environment in Vietnam. Sales of equipment, technologies and consulting and management services associated with growth in Vietnam’s industrial and export sectors and implementation of major infrastructure projects continue to be a major source of commercial activity and interest for U.S. firms. In terms of infrastructure, the Asian Development Bank (ADB) released figures in April 2017 that mark Vietnam’s public and private infrastructure investment as the highest in Southeast Asia, accounting for an average of 5.7 percent of the country’s gross domestic product (GDP).

In 2020, Vietnam’s per capita GDP was USD 2,777, a more than 2 percent increase compared to USD 2,715 in 2019. The Vietnamese government’s stated goal is to increase this to at least USD 18,000 by 2035. With disposable income levels in major urban areas four to five times the national average, significant opportunities in the consumer goods and services sectors are fast emerging. This is evidenced by strong growth in the number of Vietnamese students attending university in the United States, and the growing number of middle-class Vietnamese that are choosing the U.S. as a vacation destination.

Telecommunications, information technology, power generation, transportation infrastructure construction, environmental project management and technology, aviation, defense, and education will continue to offer the most promising opportunities for U.S. companies over the short term as infrastructure needs continue to expand with Vietnam’s pursuit of rapid economic development. Healthcare will also be a growing sector as the government expands programs and an increasingly wealthy population spends more on medical treatment.

The Government of Vietnam (GVN) plays a significant role in the economy, with state-owned enterprises (SOEs) making up 28 percent of GDP. The GVN strategy to “equitize” (partially privatize) SOEs in all sectors of the economy is slowly moving forward. While the GVN will maintain majority ownership in the largest and most sensitive sectors of the economy – including energy, telecommunications, aviation, and banking – the equitization process could present opportunities for U.S. companies.

Key U.S. agricultural inputs to production such as hardwood lumber, cotton, hides, skins, and feed ingredients will also continue to play a key role in helping to fuel Vietnam’s export led manufacturing strategy and, as noted earlier, are responsible for U.S. agricultural products accounting for nearly half of total exports to Vietnam. Demand continues to also grow for consumption of products such as meat, dairy, and fresh and dried fruits.